1.0. Introduction:

In recent weeks, there has been a ranging discourse on the Nigerian government mulling over a decision on whether to remove subsidy on electricity or not. In 2020, the Federal Government, under President Muhammadu Buhari, initiated the phasing out of electricity subsidies with the introduction of the Service Based Tariff (SBT). SBT is a tariff based on the number of hours of electricity service a consumer receives from the Distribution Company (DisCo).[1] Between 2015 and 2020, the electricity tariff shortfall averaged N200 billion annually, reaching a staggering N600 billion in 2022.[2] The Nigeria Electricity Regulatory Commission (“NERC”) introduced the Multi-Year Tariff Order (MYTO) 2022 to gradually eliminate the subsidy. However, challenges arose with the freeze on tariff reviews in July 2023, disrupting the progress made in phasing out the subsidy. Aside from the policies issued by the Federal Government towards phasing out electricity subsidy, there have been various discussions toward the phasing out of electricity subsidy. In 2021, the former Vice President of Nigeria, Professor Yemi Osibanjo, SAN, disclosed that a significant portion of the subsidy payments in the electricity sector, amounting to an estimated N30 billion per month, was expected to cease by 2022.[3] In 2022, The Chairman of the NERC, Sanusi Garba noted that the payment of electricity subsidy by the Federal Government is unsustainable due to the expected profit returns by investors.[4] In a more recent development, Nigeria’s Minister of Power, Adebayo Adelabu has proposed that the administration led by President Bola Tinubu should contemplate the removal of electricity subsidy to promote the efficient utilization of energy in the nation.[5]

2.0. Potential Implications on the Removal of Electricity Subsidy:

2.1. Market Efficiency:

Removing electricity subsidy can contribute to the efficiency of the electricity market by allowing prices to reflect the true costs of production. This can encourage investment, competition, innovation, and more efficient resource allocation.

2.2. Budgetary Savings:

The 2023 Third Quarter report issued by NERC revealed that, due to the absence of cost-reflective tariffs across all Distribution Companies (“Discos”), the government incurred a subsidy obligation of N204.59 billion in 2023/Q3 (average of N68.20 billion per month), which is an increase of N69.37 billion (+51.30%) compared to the N135.23 billion (average of N45.08 billion per month) incurred in Second Quarter of 2023.[6]

It has also been noted that from 2015 to 2023, Nigeria allocated N3.2 trillion for electricity subsidy, and in 2024, an additional N1.6 trillion is projected to be spent on electricity subsidy.[7]

Essentially, the subsidization of electricity represents a financial burden on government budgets. Eliminating or phasing out this subsidy can free up public funds, allowing governments to allocate resources to other pressing needs such as healthcare, education, and infrastructure.

2.3. Encouraging Energy Efficiency:

The removal of electricity subsidy could ensure that consumers use electricity efficiently. Without electricity subsidy, consumers may be more inclined to adopt energy-efficient technologies and practices, contributing to overall energy conservation.

2.4. Encouraging Private Sector Investment:

The removal of electricity subsidy can attract private sector investment by fostering a more predictable and stable market environment. Investors may be more willing to participate in the energy sector when prices are determined by market forces.

3.0. Addressing the Challenges:

As highlighted above, the removal of subsidy will have a great potential on the Nigerian economy. However, there are still challenges that hinder the efficiency and overall effectiveness of the Nigerian electricity sector. Addressing these challenges is crucial for the sustainable development of the sector. Some key challenges include:

3.1. Inadequate Metering:

Most end-users in the Nigerian Electricity Supply Industry (“NESI”) are substantially unmetered.[8] Where customers are adequately metered, there will be accountability for energy consumption, and this will cause a great reduction in Aggregate Technical Commercial & Collection (“ATC & C”) losses. This will increase the revenue generation in the power sector value chain.

In recent years, there has been a focus in Nigeria on increasing the metering of consumers to enhance accuracy in billing and promote transparency. Initiatives such as the National Mass Metering Program (NMMP) aim to accelerate the deployment of meters to both residential and commercial consumers.[9]

3.2. High ATC & C Losses:

Despite the subsidization of electricity by the Federal Government, high ATC & C loses still have great impact on the power sector. Reducing ATC & C losses is a priority in the Nigerian power sector to improve the overall efficiency of the electricity distribution system and ensure financial sustainability. High ATC&C losses can adversely affect the financial viability of distribution companies and the reliability of the power supply.

It has been advocated that, rather than advocating subsidies to reduce energy costs, the focus should be geared towards measures to prevent energy theft and improve payment behavior. This will reduce the tariff loss and, as a result, reduce end-user’s tariff.[10]

3.3. Transmission and Distribution Constraints:

The transmission and distribution infrastructure in Nigeria faces significant challenges, including technical losses, theft, and outdated equipment. Improving and modernizing these components is essential for a reliable power supply.

3.4. Inadequate Investment:

The electricity sector requires substantial investment in infrastructure, maintenance, and technology. A lack of sufficient funding hampers the sector’s ability to expand capacity and improve overall efficiency.

3.5. General distrust in the Government

Despite the recent elimination of subsidies on Petroleum Products, the positive effects of this action have not been felt by Nigerians. Therefore, for the potential removal of electricity subsidies to be successful, the government must effectively communicate and assure the public that the funds saved from subsidy elimination will be allocated to address needs in other sectors.

3.6. Public Consultation and Awareness:

Interestingly, most electricity end users are not aware that electricity is being subsidized by the government. Increasing public awareness about the importance of responsible energy consumption, payment of bills, and discouraging electricity theft is crucial for the sector. In line with Section 34(2)(c) of the Electricity Act 2023 (“EA”), which mandates NERC to establish appropriate consumer rights and obligations regarding the provision and use of electricity services, NERC in the past few months have conducted a number of stakeholders workshop to enlighten customers.[11]

4.0. Electricity subsidies in order African jurisdictions:

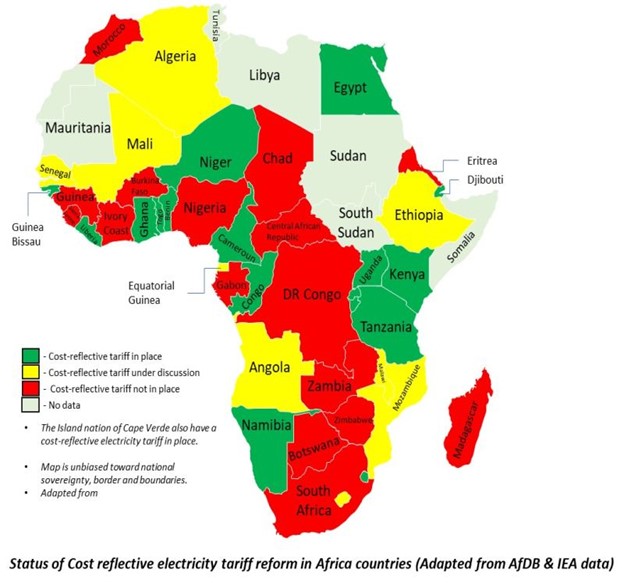

As illustrated below, most African countries still operate an electricity market with no cost-reflective tariffs.

5.0. Conclusion:

In many African nations, electricity tariffs often do not accurately represent the actual expenses incurred in providing electricity. This stems from inadequate market depth, poverty, and diminished purchasing power. This discrepancy leads to market inefficiencies and substantial revenue losses. To maintain lower tariffs and ensure widespread affordability, the government compensates for this revenue gap by offering subsidies.

Non-reflective cost tariffs and various losses pose challenges for the energy sector, making it difficult to attract investment and impeding infrastructure growth. To overcome these hurdles, a cost-reflective tariff system is essential. This system would require end-users to bear the complete cost of their electricity consumption without government interference. Such a framework aims to enhance the financial stability of utility companies, leading to improved services, while simultaneously relieving the government of fiscal burdens, enabling a more focused approach in other sectors.

Nevertheless, it is crucial to thoroughly consider the social impact of discontinuing electricity subsidy at this time. Given the context of unprecedented inflation, fluctuations in foreign exchange rates, and the untold hardship experienced by Nigerians, opting to eliminate electricity subsidy might not be the most prudent decision at present. In alignment with this view, the Nigerian Senate recently rejected the move by the federal government to increase electricity tariffs through the removal of subsidy.[12] This indicates the widespread disapproval among Nigerians regarding the electricity subsidy removal.

While electricity subsidy may provide immediate relief to consumers, it also comes at a cost. Subsidies can strain government budgets, distort market mechanisms, and discourage energy efficiency. Over-reliance on subsidies may also hinder the development of sustainable energy practices.

It’s important for governments to carefully design and implement electricity programs to balance the goals of affordability, sustainability, and economic efficiency. Policymakers need to consider the long-term impact of subsidies on the energy sector and explore complementary measures, such as improving energy infrastructure, promoting renewable energy sources, and implementing demand-side management initiatives.

Please do not treat the foregoing as legal advice as it only represents the public commentary views of the authors. All enquiries on this Brief should please be directed at:

Oyeyemi Oke

Partner

oyeyemi.oke@ao2law.com

David Akpeji

Associate

david.akpeji@ao2law.com

Olajide Akibu

Associate

olajide.akibu@ao2law.com