A. Introduction

1. In January 2023, the erstwhile President of Nigeria (President), Muhammadu Buhari, assented to the Nigerian Tourism Development Authority Act 2022 (Act) to regulate the Nigerian tourism industry (Industry). The Act which expressly repealed the now former Nigerian Tourism Development Corporation Act, is the new specific and substantive legislation for the Industry. In this brief, we explore the potentials of the Act in bringing the much yearned for development in the Industry, highlighting its significant introductions and reforms. This brief takes special interest in the soft infrastructure, especially funding that the Act brings in its wake, with the view of pointing Industry players in the right direction along with the deserving conversations to be had.

B. The Regulators:

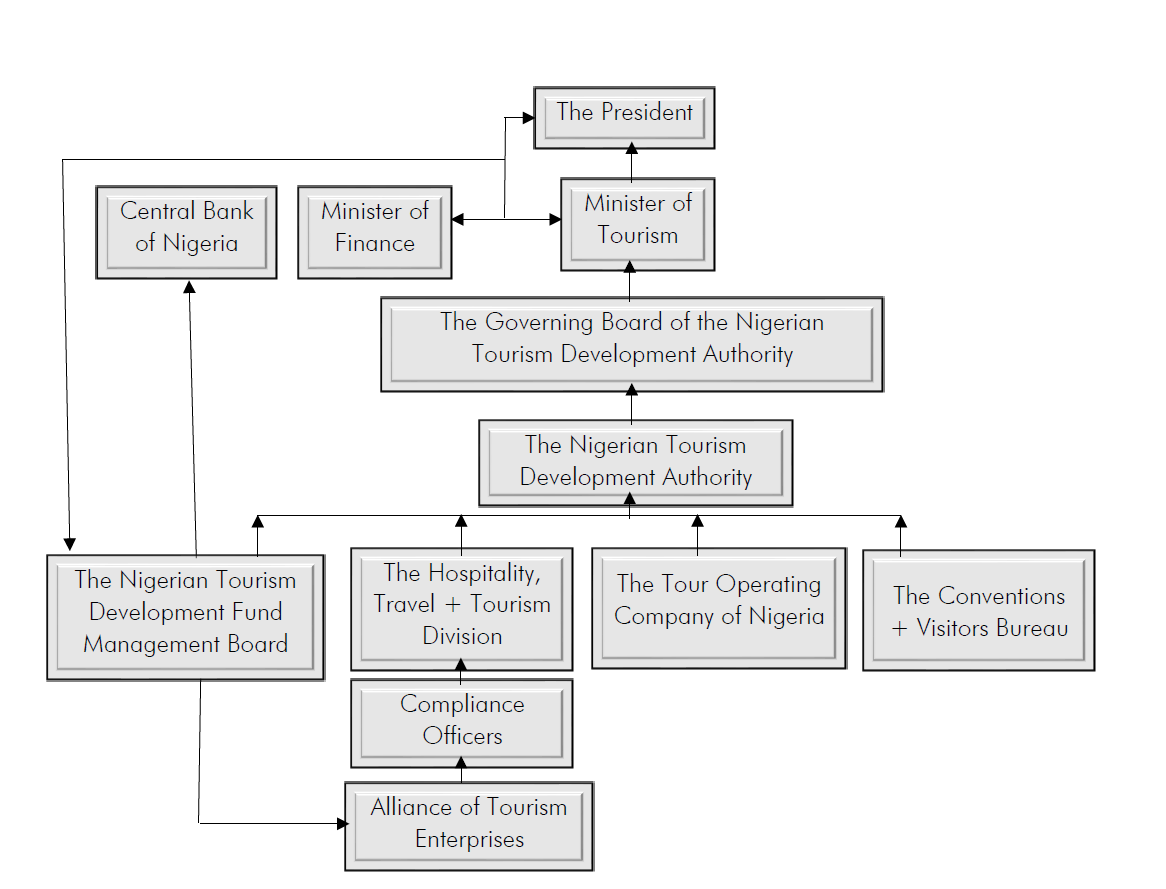

2. The Act creates a rather complex and multi-layered regulatory structure with differing institutions best pictured in this organogram:

3. Summarily, at the apex of the Industry’s regulation is the President who appoints his Ministers, the Chairman of the Governing Board of the Nigerian Tourism Development Authority (the Board) and the Director-General of the Nigerian Tourism Development Authority (the Authority). The Board supervises the Authority, although the Minister can directly give instructions to the Authority. Details of the other institutions shall be seen in the other aspects of this brief.

C. The Hospitality, Travel and Tourism Division:

4. Prior to the conversation on the opportunities that the Act provides, focus must be had on the scope of its enforcement powers. Significant in this regard is the Authority’s Hospitality, Travel and Tourism Division (the Division) which is empowered with the following far-reaching responsibilities of the Authority, to wit, the:

4.1 classification, accreditation, and grading of tourism organisations in accordance with standards set by the Authority; and

4.2 imposition and enforcement of the Authority’s sanctions.

5. The powers of the Authority to accredit and grade all tourism establishments (Accredited Members) is expressed to be in furtherance of creating an Alliance of Tourism Enterprises (the Alliance) that meet with the Authority’s standards of quality assurance, consumer protection, public health, and safety.

6. Accreditation and renewal of accreditations is an annual compliance requirement that must be met by all tourism organisations between April 1 and September 30. This means that all tourism organisations must obtain their accreditation and Accredited Members, their renewal, all before September 30 of every year.

7. Failure to be accredited or renew accreditation are offences punishable with a minimum fine of N200,000 or imprisonment of a term not more than two years, or both, plus a further fine of N5,000 for each day during which the offence continues.

8. Accreditation is stated to confer such benefits as:

8.1 certification of and promotion by the Authority;

8.2 recognition by the World Tourism Organisation;

8.3 eligibility for:

8.3.1 specific fiscal or tax reliefs or exemptions including custom duty exemptions;

8.3.2 financial incentives, subsidy, grants, and concessionary interest loans from the Tourism Development Fund (the Fund);

8.3.3 in respect of some hotels, the authorization of the Central Bank of Nigeria (CBN) for them to buy and sell foreign exchange.

9. To ensure compliance with the Act, the Authority is empowered to appoint Compliance Officers who are statutorily empowered to:

9.1 enter, inspect, examine and undertake such investigation of any Accredited Member’s hospitality facility;

9.2 notify (Improvement Notice) Accredited Members to take measures to rectify any defects or meet prescribed standards within a specified period failing which the Compliance Officer will serve a Notice of Non-compliance on the Accredited Member. A further refusal to comply with an Improvement Notice will result in loss of membership of the Alliance, and issuance of a Public Notice Disclaimer.

D. Nigeria’s New Tourism Development Fund:

10. The Act creates the Fund to be managed by the Nigerian Tourism Development Fund Management Board (the Board). The Fund has a wide range application, including to fund tourism development and related projects in the areas of, tourism:

10.1 capacity building (education/training)

10.2 entrepreneurship

10.3 export

10.4 financial incentives (subsidy, grants, and concessionary interest loans)

10.5 infrastructure

10.6 market research

10.7 promotion and marketing

11. The Fund which will be kept with CBN in accordance with the Federal Single Account Policy, will be sourced from:

11.1 The Federal Government of Nigeria’s (FGN) seed capital, intervention fund, contribution, loans, or grants.

11.2 Donations from States and the Federal Capital Territory; Local Government Areas; Ministries, Departments and Agencies of Governments; private organisations and individuals.

11.3 3% of the Tourism Development Levy (which we shall shortly touch on).

11.4 Revenues from the Authority’s projects, investments, and services.

11.5 Sums approved by the President, following the joint pre-approvals of the Ministers of Tourism and Finance.

12. The Act creates a Tourism Development Levy (the Levy) which is to be imposed by the Authority on:

12.1 tourism visas at such rate as to be determined;

12.2 hotel rooms at 1% of the room rate or such rate as to be determined by the Authority;

12.3 outbound (of Nigeria) travelers at such rate as to be determined by the Authority;

12.4 such other basis as the Authority may prescribe.

E. Nigeria’s New Tour Operating Company:

13. The Authority is required to set up a tour operating company (the Company) that will render tour services within and outside Nigeria. The Company, which is mandated to operate offices in the Nigeria’s geo-political zones to encourage tourism, will be ran commercially for it to generate and manage its revenues.

We note that as a commercial enterprise, the Company enjoys no special commercial status as it is bound to adhere with the rules of fair competition which entails the obligation to operate competitively alongside other private commercial entities in accordance with Nigeria’s competition law.

F. The Conventions + Visitors Bureau:

14. The Authority shall establish and manage a Conventions and Visitors Bureau (the Bureau) to oversee destination marketing and promote Nigeria as a top destination for events. In this wise, the Bureau will engage in biddings for Nigeria to host international events.

G. Conclusion:

15. The Act should bring with it the hope of greater development in the Industry. This is an aspirational statement that will require the implementation of the Act to validate. In other words, we need to see the Act in operation to know if Nigeria has gotten it this time around. With the global tourism industry trending at almost 5% of global GDP, the Industry’s current less than 2% of Nigeria’s GDP has room for significant improvement. That improvement will be birthed on the altar of pragmatism and progressivism; two concepts that reflect a high dose of “flexibility”. The flexibility required will ultimately be that of the Legislature who must be alert to monitor the Act in action and be ready to amend it if at all it attempts to stifle the Industry. The Act was made for the Industry and not vice versa. All hands must thus be on deck to ensure that the growth of the Industry remains the theme of discourse. Perhaps the discourse may lead to ensuring that the horse is finally put before the cart by revisiting and restating Nigeria’s 33 year old 1990 Tourism Policy to bring it line with the realities of modern, post-Covid, tourism.

16. Last mention must be made of the Levy and other taxes that tourism businesses are currently subject to. With +20 different tax obligations in the Industry owed to Nigeria’s 3 tiers of Government, the Levy is arguably another nail on the coffin of the Industry; not especially with the wide powers given to the Authority to determine most of the rates. We conclude with the poser whether existing taxes cannot be employed to meet the funding obligations of the Act.

Please do not treat the foregoing as legal advice as it only represents the public commentary views of the authors. All enquiries on this Brief should please be directed at:

Bidemi Olumide

Managing Partner

bidemi.olumide@ao2law.com

Joseph Ajah

Senior Associate

joseph.ajah@ao2law.com

Uwemedimo Atakpo Jnr

Associate

uwemedimo.atakpo@ao2law.com

Oghenekaro Isiorho

Associate

oghenekaro.isiorho@ao2law.com